Claim Your Home Renovation Primary Tax Exemption Now Easily Today Online

Taking advantage of the primary tax exemption on your home renovation has never been easier, and now you can quickly and conveniently claim it online from the comfort of your own home. By doing so, you can save a significant amount of money that would have otherwise gone to taxes, and instead, use it to further improve your living space or invest in other important areas of your life. With the online claim process being straightforward and user-friendly, you can submit your application today and start enjoying the financial benefits of your home renovation tax exemption sooner rather than later.

Apply Now For Land Tax Exemption On Your PPR Construction Or Renovation Project Today

Take advantage of land tax exemption for PPR construction or renovation to significantly reduce your financial burden and increase your savings over time Apply for land tax exemption as soon as possible to maximize your benefits and minimize your expenses on PPR construction or renovation projects

Land Tax Exemption for Private Property Renovation and Construction

Land tax exemption for PPR construction or renovation is a valuable incentive that can help reduce the financial burden on property owners and developers who are investing in affordable housing projects this exemption can lead to significant cost savings which can be passed on to homebuyers making affordable housing more accessible and attractive to a wider range of people land tax exemption can also stimulate economic growth by encouraging investment in the construction and renovation of affordable housing units property owners and developers can benefit from land tax exemption for PPR construction or renovation by reducing their tax liability and increasing their cash flow

Discover How to Save Thousands on Your Property Tax Bill with This Ultimate Guide to Property Tax Exemption

Take immediate action to understand the eligibility criteria and application process for property tax exemption to potentially save thousands of dollars on your annual tax bill Familiarize yourself with the specific rules and regulations regarding property tax exemption in your area to ensure you do not miss out on this valuable opportunity to reduce your tax liability

Understanding Property Tax Exemption Requirements

A complete guide on property tax exemption provides invaluable insights and expert advice for homeowners and investors looking to minimize their tax liabilities and maximize their savings through various exemption programs and strategies available in different states and local governments Understanding the intricacies of property tax exemption laws and regulations can be complex and time consuming but with the right guidance individuals can navigate the process with ease and confidence By exploring the different types of exemptions and eligibility criteria individuals can make informed decisions about their properties and financial situations

Apply Now For Property Tax Exemption With These Top Tips In 2024

Apply for property tax exemption as soon as possible to avoid missing the deadline and to ensure you receive the maximum amount of savings on your property taxes in 2024 Review the eligibility criteria and required documents carefully to increase your chances of a successful property tax exemption application and to minimize the risk of rejection or delay

Maximizing Your Property Tax Savings With Exemption Applications

applying for property tax exemption in 2024 can be a daunting task but with the right guidance you can navigate the process with ease and maximize your savings by following the top tips that include understanding the eligibility criteria and required documents to submit a successful application filing for property tax exemption requires careful planning and attention to detail to avoid common mistakes that can lead to rejection of your application knowing the top tips for property tax exemption application can help you make informed decisions and take advantage of the available exemptions to reduce your tax burden

Find Out If You Can Deduct Home Renovation Costs From Your Taxes Now

You should understand the tax implications of home renovations to maximize your savings and minimize your financial burden when upgrading your property You need to consult with a tax professional to determine which home renovation expenses are eligible for tax deductions and how to properly document them for your records

Home Renovation Tax Deductions Explained

Home renovations can be a significant investment for homeowners and understanding the tax implications is crucial for maximizing returns many homeowners wonder if home renovations are tax deductible and the answer is yes but only under specific circumstances such as when the renovation is deemed a medical necessity or when the home is being used as a rental property. Home renovation tax deductions can help offset the costs of upgrades and improvements made to a primary residence or investment property. Homeowners can claim tax deductions on home renovations that increase the value of their property or improve its functionality

Fix Your Property Tax Exemption Now And Save Thousands Every Year

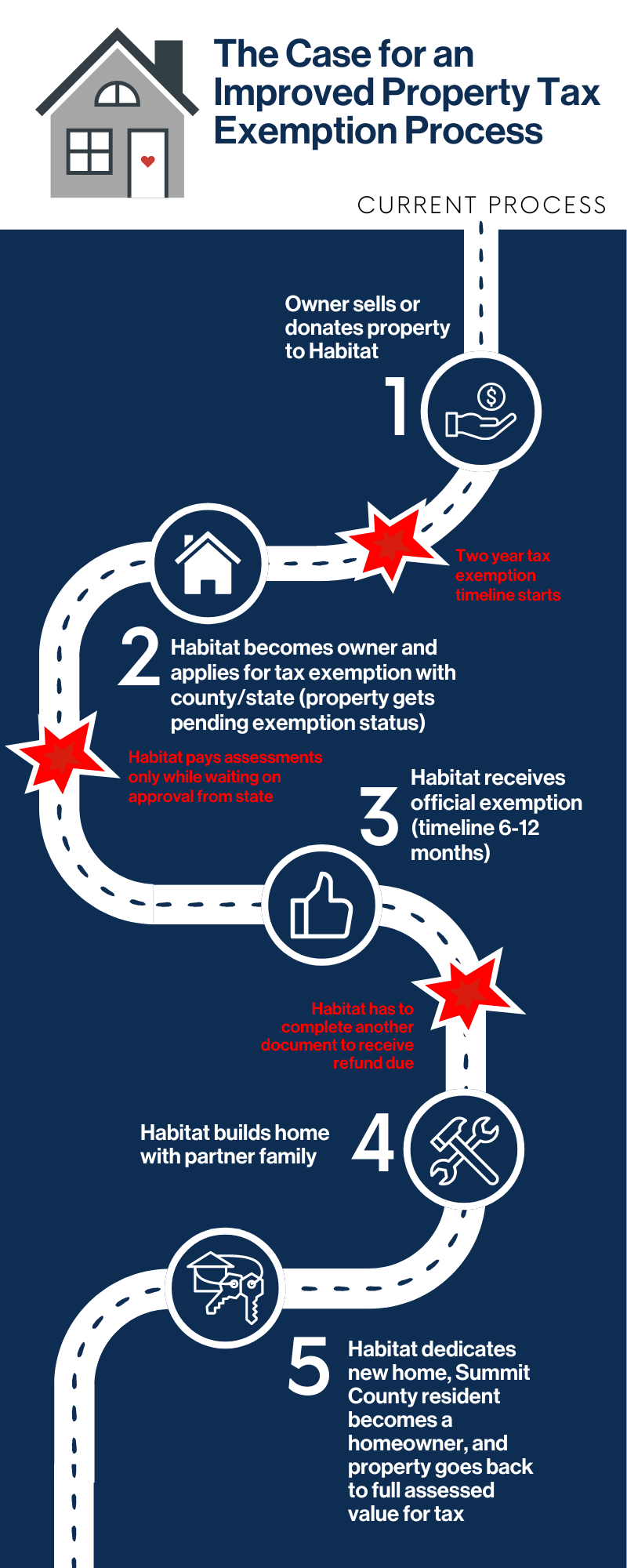

We need to reform the property tax exemption process to make it more efficient and accessible for homeowners and businesses to take advantage of the benefits they are eligible for and reduce their tax burden. It is essential that we simplify the application process and provide clear guidelines to help individuals and organizations navigate the system and ensure they receive the exemptions they deserve

Simplifying Property Tax Exemption Procedures

The case for an improved property tax exemption process is rooted in the need for streamlined and efficient systems that can effectively manage the complexities of tax exemptions and provide clarity for homeowners and businesses alike in a rapidly changing economic landscape where transparency and accountability are paramount An improved process would also help to alleviate the administrative burdens that often hinder local governments and municipalities from effectively implementing tax exemption policies that can have a significant impact on community development and economic growth By leveraging technology and data driven approaches an improved property tax exemption process can help to reduce errors and inconsistencies while also providing valuable insights and analytics that can inform policy decisions and drive better outcomes for all stakeholders involved

Claim Your Homestead Exemption Now And Save Big On Taxes Learn How It Works

You need to understand what a homestead exemption is and how it can save you money on your property taxes by reducing the amount of taxable value on your home. Take action now to apply for a homestead exemption and protect your home from creditors and lower your tax liability at the same time

Understanding Homestead Exemption Benefits

A homestead exemption is a valuable tax benefit that allows homeowners to reduce their property tax liability by exempting a portion of their home's value from taxation this exemption can vary by state and locality but it often provides significant savings for eligible homeowners who meet specific requirements such as using the property as their primary residence the exemption works by shielding a certain amount or percentage of the home's value from property taxes which can lead to lower tax bills and increased affordability for homeowners homeowners can typically apply for a homestead exemption through their local tax assessor or county government office and must provide required documentation to support their eligibility

Get Your Contractor Tax Exemption Certificate Letter Template Now And Save On Taxes

You need to download a letter template for contractor tax exemption certificate to ensure you are meeting all the necessary requirements for your business operations You should fill out the template carefully and accurately to avoid any potential issues with your tax exemption status and to maintain compliance with relevant laws and regulations

Contractor Tax Exemption Certificate Template

obtaining a contractor tax exemption certificate can be a straightforward process with the right letter template which provides a clear and concise format for contractors to outline their exemption status and supporting documentation to relevant authorities and clients for verification purposes using a well crafted letter template for contractor tax exemption certificate helps ensure that all necessary information is included and presented in a professional manner this can help to streamline the exemption process and minimize delays or disputes related to tax exemption claims